Vehicle mileage depreciation calculator

To use the calculators depreciation formula on line 10 enter the total price you paid for your new or used vehicle including sales tax. If you use the actual expenses method and the vehicle was acquired new in 2021 the maximum first-year depreciation deduction including bonus depreciation for an auto in 2021 is 18200.

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

If neither is relevant to you consider the standard mileage method.

. Is a finance method that allows you to purchase a vehicle with a monthly payment over a fixed period of time and then the option to make a balloon payment. Since you dont spend money on gas with an electric car its likely that the mileage deduction will get you a bigger tax break. Also aggressive braking can have a toll on.

The Car Depreciation Calculator uses the following formulae. Keep clear and precise records if you claim the standard mileage deduction or all of your receipts if you want to claim vehicle expenses. D P - A.

Market Value trade-in price for a typically-equipped vehicle assuming accumulated mileage of 15000 miles per year. It will also determine whether or not a car is still under warranty. Enter the amount of your down payment if you are financing the vehicle.

Find out with Edmunds Lease vs Buy Car Calculator. Check out also our lease mileage calculator and car loan EMI calculator. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

The average car depreciation rate is 14. If you purchase a used Tesla Model 3 that is 2 years old then you could save 0 compared to buying new and still have a relatively new model with plenty of useful life remainingIf you plan to keep this vehicle for 3 years then your total cost of depreciation would be 12625Try other age and ownership length combinations or different. The first and most comprehensive method is to document all of your car expenses including gas maintenance insurance and depreciation.

This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been. Gas repairs oil insurance registration and of course depreciation. Or if you want the calculator to use a percentage to compute the down payment amount expand the description and enter the percentage without the percent sign and the calculator will calculate the amount and enter it into the appropriate fields Total price of car entry is required.

Vehicle Valuation Calculator Calculate Vehicle Value online. Lets say youre going to lease it for three years and over those three years its going to depreciate by 20000. Scholars at the Stanford University School of Medicine performed a study in which they investigated the rate at which the interior temperature of a parked car increased during sunny days of temperatures between 72 and 96 degrees Fahrenheit.

Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Edmunds True Cost to Own TCO takes depreciation. Mileage is a good indicator of how much wear and tear is on a vehicle affecting its value.

Vehicle Registration Tax estimated 2190. If only 50 percent of the motorcycles mileage was for business then the business could deduct only 200 in depreciation. In the example above your depreciation on an auto would be limited to the business-use percentage of 90 times the maximum 2021 first-year maximum of.

You can then calculate the depreciation at any stage of your ownership. Heres what you need to use our lease payment calculator. This free gas mileage calculator estimates gas mileage based on odometer readings gas price per gallon and the amount of gas in the tank.

Notice 2020-05 PDF posted today on IRSgov contains the standard mileage rates the amount a taxpayer must use in calculating reductions to basis for depreciation taken under the business standard mileage rate and the maximum standard automobile cost that a taxpayer may use in computing the allowance under a fixed and variable rate plan. Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model. We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time.

Not to have as heavy a foot as steady acceleration is not only much safer but is more efficient and is kinder to the depreciation of the vehicle. If youre looking to finance the purchase of a new recreational vehicle RV our RV loan calculator makes it simple to work out what the best deal will be. Depreciation is the decrease in the vehicles value due to age and use.

Using our commute cost calculator couldnt be easier. This monthly mileage report template can be used as a mileage calculator and reimbursement form. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

Car Depreciation Calculator. Rate of Depreciation for this Vehicle. Commuting is expensive and the costs of gas maintaining a vehicle and the wear and tear from the mileage accumulated are not often factors people build into their budgetsThis calculator takes into consideration factors like round trip mileage your cars specifications and the days per month.

Loan interest taxes fees fuel maintenance and repairs into. Make Sure You Qualify for Mileage Deduction. You drive an electric vehicle.

The actual expenses method lets you deduct depreciation on newer vehicles and the cost of gas. Buying a Tesla Model 3 New vs Used. There are also other methods of calculating depreciation of vehicle including the Alternative Depreciation System which lets business owners calculate depreciation at varying percentages each year.

Template features include sections to list starting and ending locations daily and total miles driven employee information and approval signatures. Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Depreciation per mile purchase price of vehicle whether bought new or used including sales taxes predicted mileage of vehicle from date of purchase until it enters junkyard.

Current OMSP determined by Revenue. Lets take that same 50000 car from the example above. You need to complete the details of your car and mileage in the travel allowance section.

Their findings demonstrated that the temperature inside a car can increase by 40 degrees Fahrenheit on average over the. One of the most important contributors to depreciation is the number on the odometer. Revenue CO 2 Calculation.

Including business costs related to vehicle depreciation registration fees lease and. A P 1 - R100 n. For 2022 that rate is 0585 per mile from January to June and 0625 per mile from July to the end of the year.

Home other. I receive a travel allowance - can I claim depreciation on my vehicle. Youd be able to claim depreciation on your vehicle but would need to prove to SARS the basis for apportioning expenses between business and private use by keeping a vehicle logbook.

On the other hand. If you frequently drive your car for work you can deduct vehicle expenses on your tax return in one of two ways. Many people use mileage as a factor when deciding whether to purchase a used car.

Calculate the cost of owning a car new or used vehicle over the next 5 years.

The True Cost Of Car Ownership The Best Interest

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

Car Depreciation Online Tool For Philippines Carsurvey

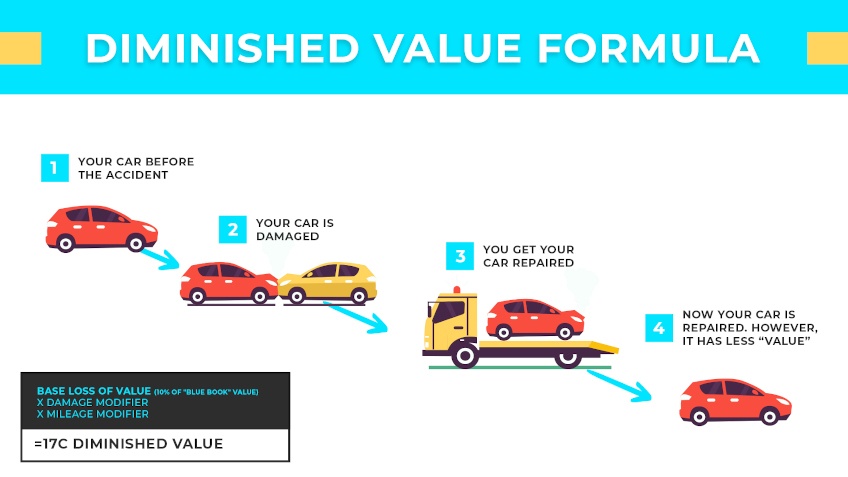

Car Value After Accident How Much Value Does A Car Lose

Car Mileage Ranking Online Tool For The Philippines Carsurvey

Car Depreciation For 1099 Contractors And Car Sharers

Car Depreciation Calculator

Depreciation What Does It Mean For Your Vehicle

What Mileage Does A Car S Value Depreciate Direct Car Buying

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Mileage Log Template For Taxes Luxury Vehicle Mileage Log James Orr Real Estate Services Door Hanger Template Templates Custom Door Hangers

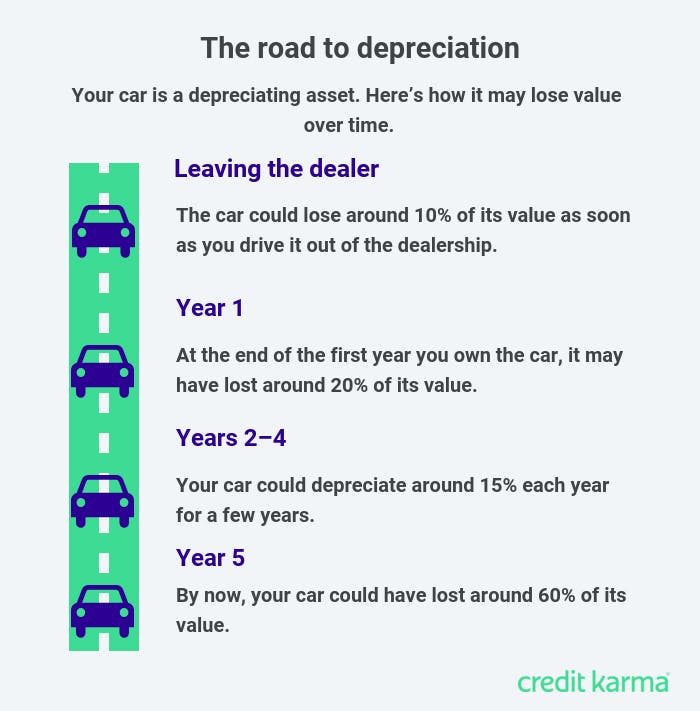

How Car Depreciation Affects Your Vehicle S Value Credit Karma

5 Logical Reasons To Buy A Used Car Visual Ly Buy Used Cars Used Car Lots Used Cars

Gas Mileage Log And Mileage Calculator For Excel

Research Which Cars Suffer From Depreciation The Most

How Car Buy Rater Works The Methods It Uses To Evaluate Cars

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent